Out of sight of the Dutch media, Trump and Xi are deciding who will control two-thirds of Rotterdam's container terminals. Will an American-European consortium gain control, or a Chinese state-owned company? Europe and the Netherlands are quietly watching as the two superpowers decide on this crucial gateway to Europe. Not everyone is comfortable with this. "You don't want other countries to be able to frustrate your imports and exports.'

In this story, you will read about:

- How Rotterdam's container transshipment is being drawn into a conflict over the Panama Canal

- How important container terminals are for the Netherlands

- What the consequences could be if the terminals fall into the hands of a Chinese state-owned company

- How Europe is ignoring this geopolitical struggle and is primarily concerned that a European company is becoming too powerful on the continent

- What Europe and the Netherlands can—and are willing—to do in this matter

I haven't heard anything about this. What's going on?

Like so many stories these days, this one begins with an obsession of Donald Trump. He not only wants Greenland, but also the Panama Canal. In his inauguration speech last January, he said that the Chinese now control it and that he wants it back. The owner of two important ports on the canal is indeed CK Hutchison from Hong Kong, the Chinese region that is increasingly losing its special status and falling under the control of the Communist Party.

CK Hutchison is a conglomerate that owns container terminals and retail chains, including Kruidvat. They didn't want any hassle, so after Trump took office, they decided to sell their ports at breakneck speed. In March last year, the company announced that it would sell all 45 of its ports and (container) terminals for $22.8 billion (almost €20 billion) to the American investor BlackRock and port operator MSC, a Swiss-Italian family business.

Why is this important for Rotterdam?

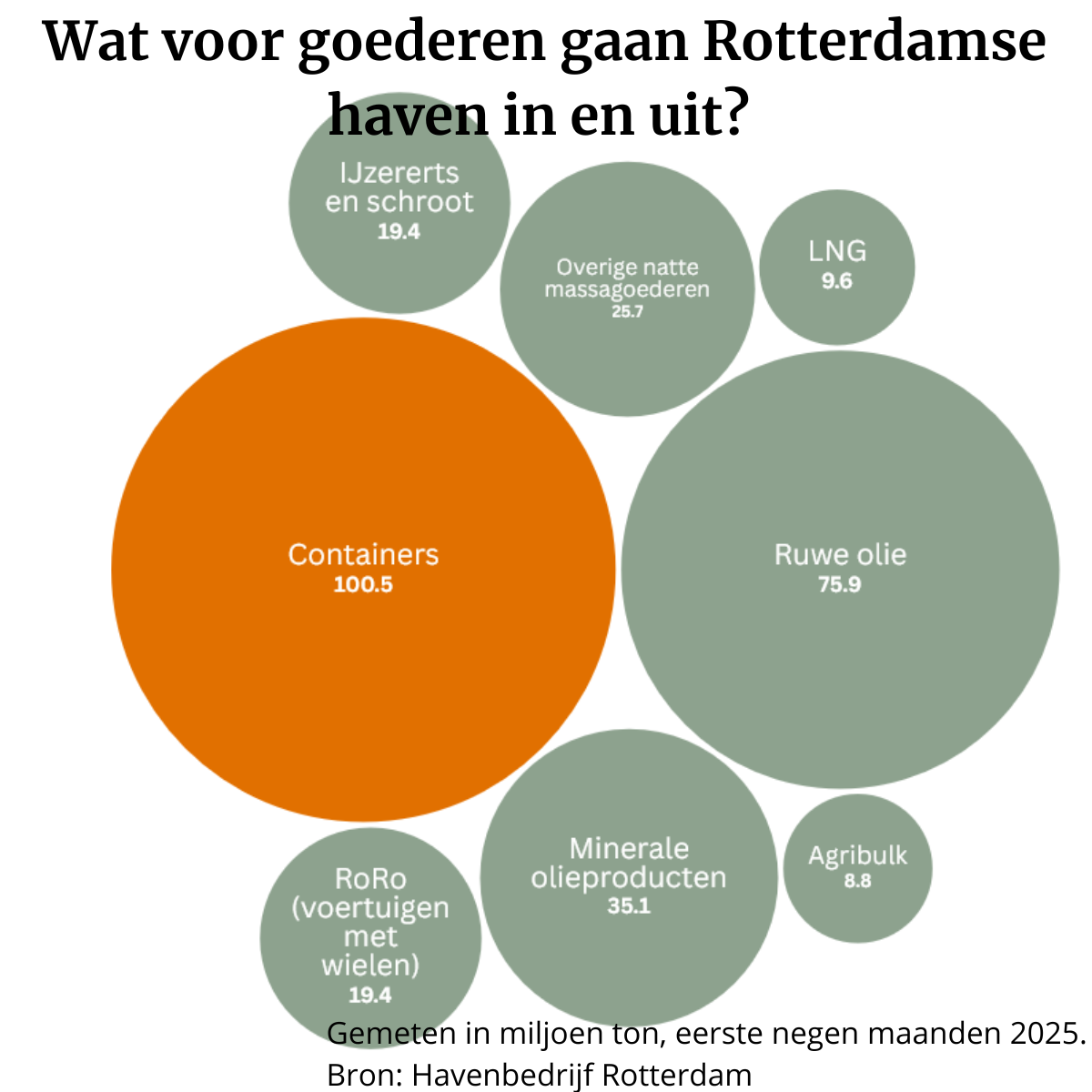

Numerous goods and raw materials enter the Netherlands via the port of Rotterdam, ranging from containers to liquefied natural gas (LNG), cars, and oil. In terms of weight, containers are the most important source of trade. In the first nine months of last year, they accounted for 101 million tons of the 320 million tons of goods.

CK Hutchison operates in Rotterdam primarily under the name ECT Rotterdam. It has the Euromax and ECT Delta container terminals in the port of Rotterdam. These terminals can handle the largest container ships in the world. Together, CK Hutchison's deep-sea terminals can process 9 million containers per year, out of a total capacity of 14 million containers in the port, according to the Port of Rotterdam Authority in response to questions from Hollands Welvaren. This gives CK Hutchison a market share of almost two-thirds. In 2024, these two deep-sea terminals will generate €589 million in turnover, according to figures filed with the Chamber of Commerce.

Those Rotterdam terminals would also be sold to BlackRock and MSC. CK Hutchison not only wanted to sell its Panamanian ports, but also throw in the towel completely. According to various media outlets, including the Financial Times, BlackRock would acquire a majority stake in the Panamanian ports (MSC would become a minority shareholder). At the other 43 ports, the European MSC would call the shots and BlackRock would take a back seat.

Sounds nice, doesn't it, a European operator instead of a Chinese one?

Yes. But because CK Hutchison is a Chinese company, the Chinese government also has a say in the matter. And a few weeks after Hutchison announced the sale, Trump started his tariff war on April 2, with tariffs reaching 124% in the case of China. China was therefore not willing to simply give in to Trump and hand over the Panamanian ports.

China demanded that the Chinese state-owned company Cosco also be allowed to participate in the consortium that would acquire the Hutchison ports, as revealed by the Wall Street Journal in the middle of last year (only in the Panamanian ports does China not have a stake). BlackRock and MSC were open to such a third shareholder, but negotiations with Cosco (China Ocean Shipping Company) dragged on. Cosco has hundreds of (container) ships and interests in various ports, such as a controversial majority stake in the Greek port of Piraeus.

A few weeks ago, the Wall Street Journal reported that the Chinese have upped their ante. They now want a majority stake and veto rights in the Hutchison ports. As long as China stands firm, Trump will not get his way with Panama. According to the business newspaper, China wants to use this trump card in the broader negotiations between China and America on their economic relationship, such as import tariffs and technological exchange.

What does that mean for the Netherlands?

The future ownership of the largest container terminals in the port of Rotterdam has been uncertain for a year now. The containers continue to come and go, but major decisions about the future, such as investments in expansion, are difficult to make.

It also means that ownership of the terminals is now part of a larger deal between Trump and Xi. Trump will not care much who gets the remaining Hutchison ports, but Xi does have an interest in this. "For China, the symbolism of Panama is important," researcher Frans-Paul van der Putten tells Hollands Welvaren. He specializes in China's geopolitical role at the Clingendael Institute. "China does not want the US to push them out of various countries step by step. That weighs heavily on China, so I think they will stand their ground."

Trump says he considers the Panama Canal important, but probably cares less about the other ports. In a larger diplomatic exchange of interests, it may well be that Trump will simply "give" the ports to China.

Can China exert additional pressure on the Netherlands?

'Commercially, it could be beneficial for Rotterdam,' says Van der Putten. 'Cosco not only has ports, but is also a shipping company with its own container ships. In the long term, it could strengthen Rotterdam's position in trade flows. But politically, it's a different story.'

This article is for paid members only

To continue reading this article, upgrade your account to get full access.

Subscribe NowAlready have an account? Sign In