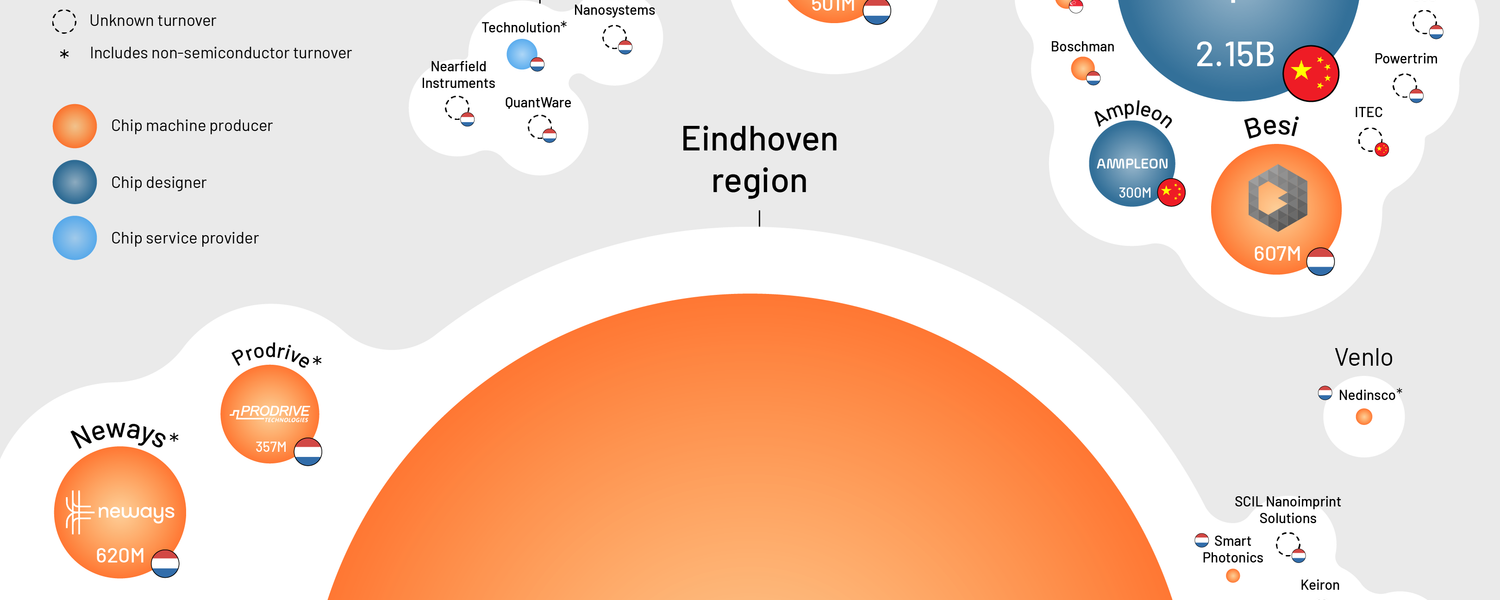

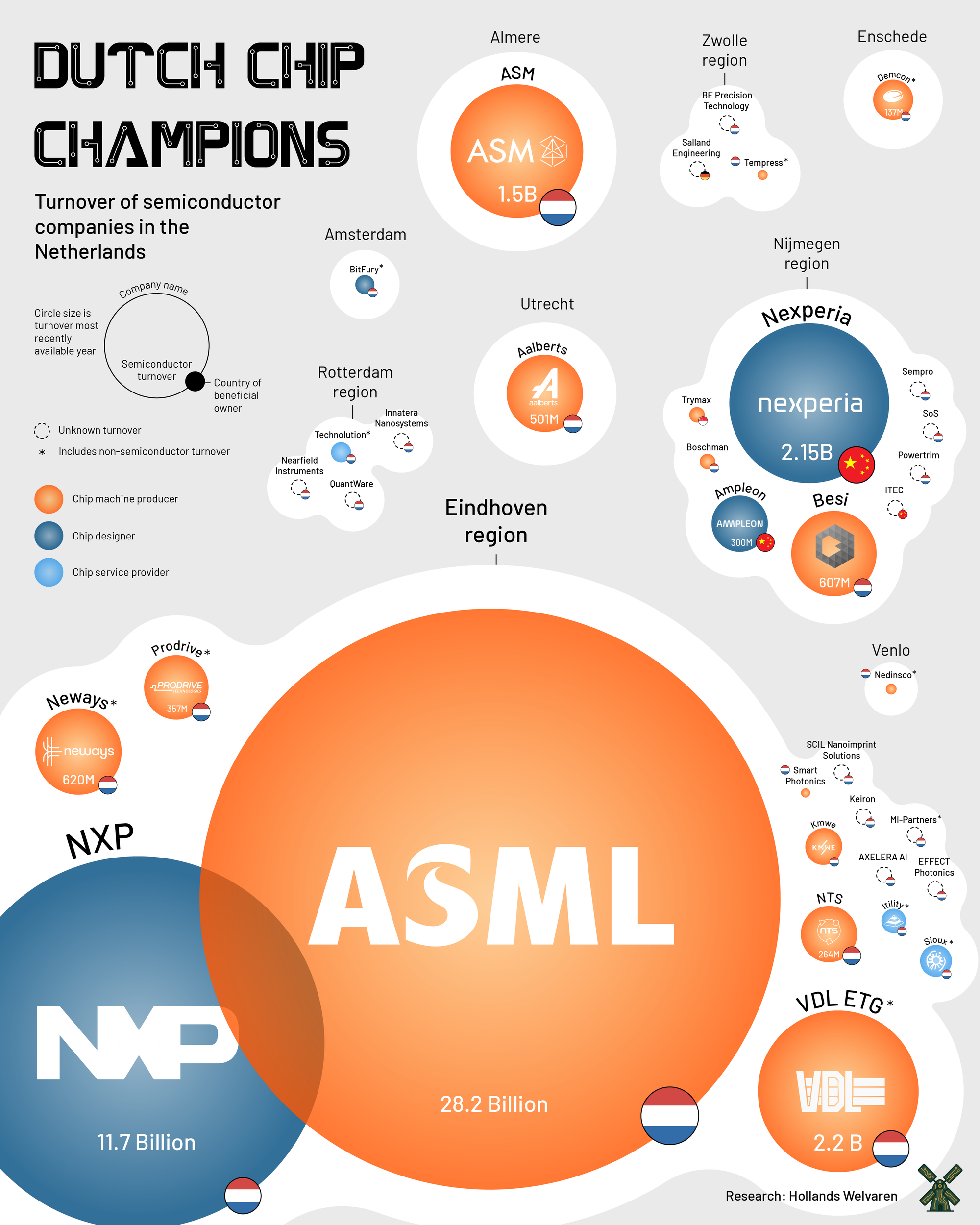

The Netherlands has the most important chip industry in Europe, but its exact size is unknown. Hollands Welvaren therefore listed the main players. ASML is by far the largest, but it relies heavily on the much smaller players in the Netherlands.

First, practically:

This is Part 1 in a three-part series on the Dutch chip sector.

- 1: These are the largest chip companies in the Netherlands

- 2: How can the Netherlands ensure that the chip sector grows rapidly?

- 3: What does China's advance mean for Dutch chip companies?

You can also read this article in English by clicking on 'Dutch' at the bottom right and adjusting the language.

Paying subscribers to Hollands Welvaren will find a table at the bottom of this article with chip sales, revenue growth, profits, main operations, founding year and country of ultimate ownership.

Subscribe now to Hollands Welvaren and get a 20% early bird discount (40 euros per year, instead of 50 euros) AND the promise that the price never rises: inflation-free.

How big is the Dutch chip sector really? If even the omniscient accountants at the Central Bureau of Statistics don't know, then you know the information simply doesn't exist.

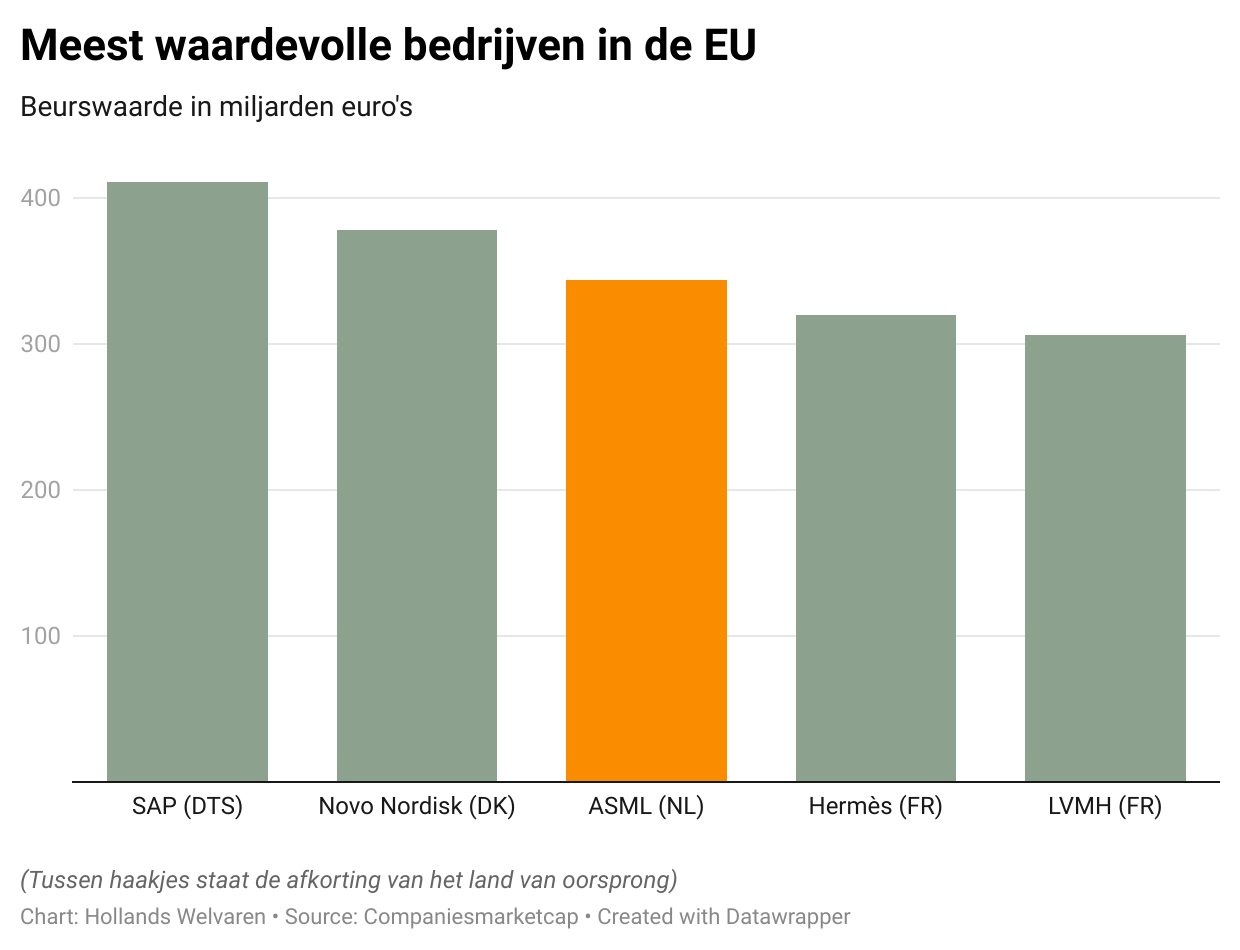

What we do know is that in recent years ASML has become the national pride. The Veldhoven-based chip machine maker is one of Europe's most valuable companies - who knows, maybe one day it will even conquer the first position. In fact, because it makes such unique machines, it is among the most valuable chip companies in the world.

So when then ASML top executive Peter Wennink hinted early last year that ASML might expand outside the Netherlands, panic set in. (When he said a few months earlier that we as a society were "fat, stupid and happy," we still laughed about it and moved on to the order of the day.)

Wennink to NOS, Jan. 24, 2024: "Ultimately, we have to deliver to our customers what our customers need. And that chip industry is only going to grow. We'd rather do it here. But if we can no longer do it here, we'll do it somewhere else.'

Soon the cabinet decided to bust the piggy bank of the national growth fund to co-finance"project Beethoven. A 2.5 billion euro project that was not only to facilitate ASML's growth by training more technicians, building roads and houses, but was to lift the entire Brainport region around Eindhoven to a higher level.

But so that actually happened by touch. Because how important is the chip sector to the Netherlands? We don't know. That's because the chip sector is so fragmented. One company makes mirrors, another supplies chemicals, yet another specializes in making difficult calculations. There is no single statistical definition for that. That is why the Central Bureau of Statistics (CBS) has no figures on it, it informs Hollands Welvaren .

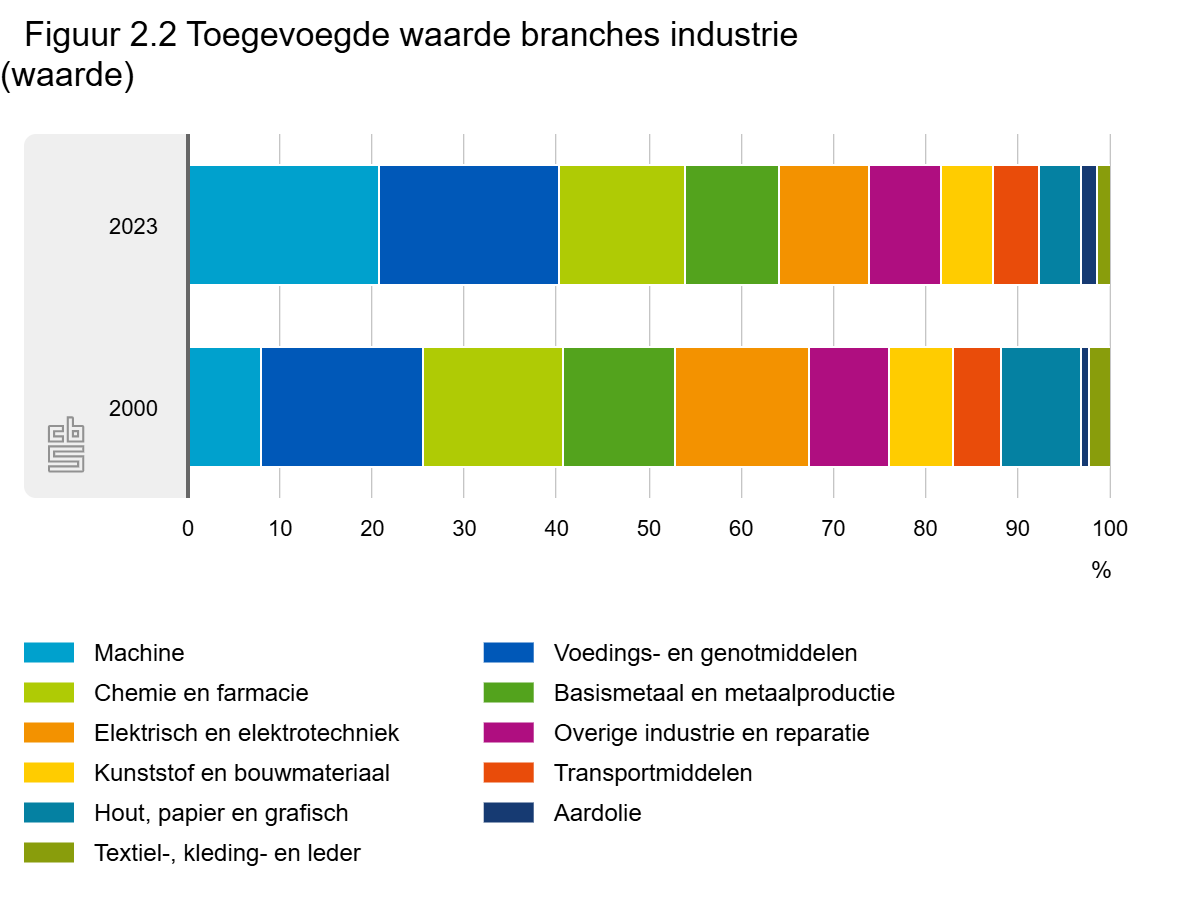

However, CBS figures do show that the machine industry (which includes ASML) is the most important industry in the Netherlands. And ING in turn estimates that ASML accounts for 57 percent of all sales in the Dutch machine industry.

To gain more insight into the Dutch chip sector and its key players, Hollands Welvaren collected figures from dozens of chip companies. Because the chip sector is so complex, it also clarifies where the Netherlands excels.

How did Hollands Welvaren investigate this?

First, a rough list of dozens of companies (potentially) active in sector was made based on various sources. Annual reports were then viewed on websites or requested from the Chamber of Commerce. On this basis, an attempt was made to estimate as best as possible what part of the turnover comes from chip-related business. The figures used are for 2024, or if those annual figures are not yet known, for 2023. Only in the case of Bitfury were figures for 2022 used because there were no more recent ones.

Basically, only chip-related sales were included, not total sales. However, this was not possible for all companies. These companies are marked with an * and they are therefore possibly with 'too high' turnover in the list. This includes VDL subsidiary VDL ETG. That is an important supplier to ASML, but also does a lot outside the chip sector, for example for Philips. VDL, however, does not want to disclose specific chip sales.

Information collected from companies included: sales and sales growth; pre-tax profits; year of incorporation (or year of separation); location of headquarters; owner (if known), and country of location; growth capital raised (if relevant).

In particular, turnover is not always known from start ups. They are included in the list anyway. They have in some cases raised tens if not hundreds of millions of growth money. This gives them a great chance to grow rapidly and become an important part of the Dutch chipecosystem.

It is possible that Hollands Welvaren has overlooked companies, made mistakes, or that there may be discussions about interpretation of "chip turnover. If you see such an error, please email especially to: info@hollandswelvaren.press

That inventory shows not only how dominant ASML is in the sector, but also how dominant 'Brainport Eindhoven' is. And the crucial role that Philips has played in building this sector. No fewer than six of the Netherlands' ten largest chip companies come directly or indirectly from the Philips family. Often these are Philips spin-offs (such as NXP), but ASML started as a joint venture of Philips. And Neways was founded by a longtime Philips employee.

With all this activity, the Netherlands has by far the most important chip cluster in Europe, American chip expert Chris Miller, author of the book Chip War, tells Hollands Welvaren. 'The Netherlands stands out. It is by far the most important player in Europe, and one of the largest in the world.'

The presence of all these chip companies is important not only economically, but also strategically, Miller says. 'It gives the Netherlands more influence. When world leaders come to the Netherlands, they often want to visit ASML as well. The South Korean president did that last year, for example.'

Because not only does the Netherlands have many chip companies, it also has unique companies. 'ASML and ASM have unique products that are crucial to the chip-making process,' Miller says. In fact, the chip industry does not operate like many other industries. Many players specialize. In many other industries, companies compete with similar products. If Coca Cola disappears from the face of the earth overnight, you can still drink Pepsi. If Shell goes bankrupt, you can still fill up at BP.

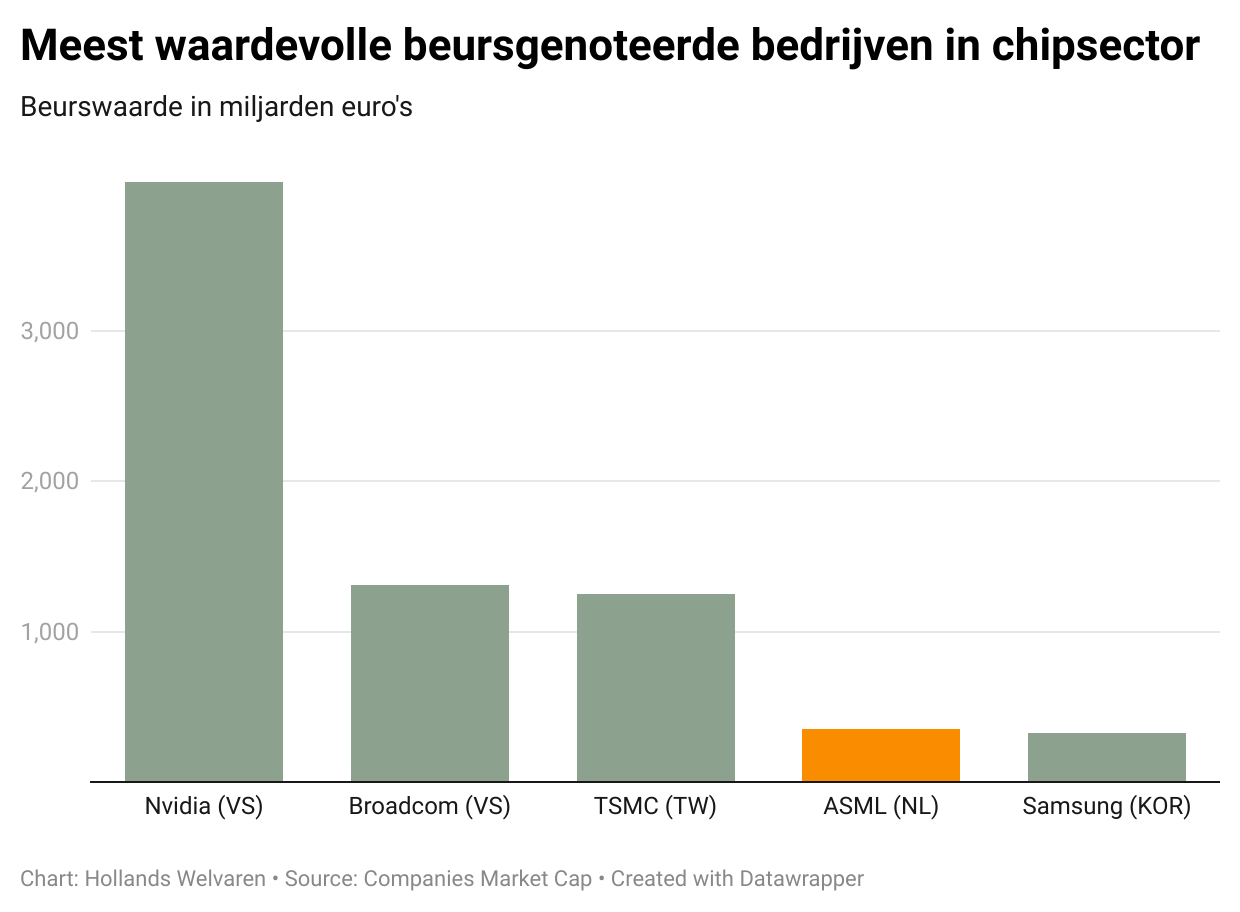

But in the chip sector, everything depends precisely on cooperation and specialization. Very roughly, there are three types of players. There are the designers who design chips. Think of Apple working on an even hipper iPhone, or Nvidia inventing the world's most advanced AI chips. However, these companies do not make these chips themselves. They do so in giant factories (often called a foundry, or fab ), such as those of TSMC (Taiwan), Intel (America) and Samsung (South Korea). But those factories can make those chips only with the most advanced machinery from machine makers. And in the latter, the Netherlands excels (see the orange companies in the infographic).

So the Netherlands does not have "just any" chip companies, mini-versions of Nvidia for example, but players that make a crucial part of the whole chain. ASML's EUV machines can make the world's tiniest chips that are crucial for artificial intelligence (AI), among other things. You can design such a beautiful chip at Nvidia, if you don't bring it to a factory that houses an ASML EUV machine, you can't make it.

And ASML, in turn, depends on numerous (often Dutch) suppliers who make crucial elements for its machines, or provide services such as calculations and process control. Important suppliers to ASML are VDL ETG, Aalberts Industries, NTS Group, Neways and Demcon. So they are effectively at the base of a very tall block tower that, via ASML and factories like TSMC's, ends up at Nvidia and Apple, some of the most valuable companies in the world.

In addition to the many chip machine makers, the Netherlands also has some specialized chip designers, some of whom also manufacture some of their products in their own fabs. The largest is NXP, which split from Philips in 2006 and supplies much of the automotive industry. In 2015, NXP split off Ampleon, which focuses on communications chips. And two years later, Nexperia, which makes chips for industry, among other things, was also divested by NXP.

The latter two companies, Nexperia and Ampleon, are in Chinese hands. But the vast majority of chip companies are still in Dutch hands. Many of the large companies are publicly traded, with shareholders from all over the world. However, there are also several family-owned companies (such as VDL and NTS Group). And young companies also manage to raise a surprising amount of money from Dutch parties (more on that in Part 2 of this series).

Together, all the Dutch chip companies inventoried Hollands Welvaren turned over some 50 billion euros in sales, although in the absence of detailed figures, some companies also include non-chip sales (such as VDL ETG). ASML alone accounts for 58 percent of that turnover. And it should also be remembered that many other chip companies earn a substantial portion of their sales by supplying ASML.

Profits were a little harder to track, but together amounted to at least 13 billion euros, with ASML accounting for two-thirds of that. ASML, with a profit of 9 billion euros over 2024, is also the second most profitable company in the Netherlands after ING.

Rapid growth

So although it is impossible to say with certainty exactly how important the chip industry is for Dutch industry, it is clear that it is a major industry. An industry that is also growing rapidly.

ASML states in its annual report that the global chip sector grew 6 percent annually between 2013 and 2023. Until 2030, that growth accelerates to 9 percent annually, ASML expects. And that growth is mainly due to the advance of artificial intelligence, which requires the most advanced chips. And let that be precisely where ASML machines are indispensable.

So in the coming years, not only ASML but also all its (Dutch) suppliers will have to work. How are they going to keep up with this growth? That is the subject of the next part in this article series.

Paying subscribers see below the table of data collected Hollands Welvaren .

This article is for paid members only

To continue reading this article, upgrade your account to get full access.

Subscribe NowAlready have an account? Sign In