Raising the state pension age appears to be the biggest sticking point for the incoming cabinet. There is considerable opposition. However, maintaining the current situation is particularly attractive to the ever-growing group of affluent people. People with demanding jobs or poor health are paying the price. Meanwhile, state pension costs continue to rise. Action is therefore needed.

In this article, you will read:

- How problematic are AOW expenditures?

- How has the increase in the state pension age progressed so far?

- Is it even practically possible to help people with demanding jobs?

Jesse Klaver has been ruthlessly excluded from the coalition talks by D66, VVD, and CDA. But this week, the GroenLinks-PvdA party leader took the initiative again. Whereas the other opposition leader, Geert Wilders, came up with a scattergun approach—everything Jetten wanted to do was, of course, bad—Klaver took aim at the faster increase in the state pension age. It proved to be effective and helped to ensure that the public debate is now focused primarily on one measure. The planned change to the state pension age thus seems to be the first major stumbling block for the coalition without a majority.

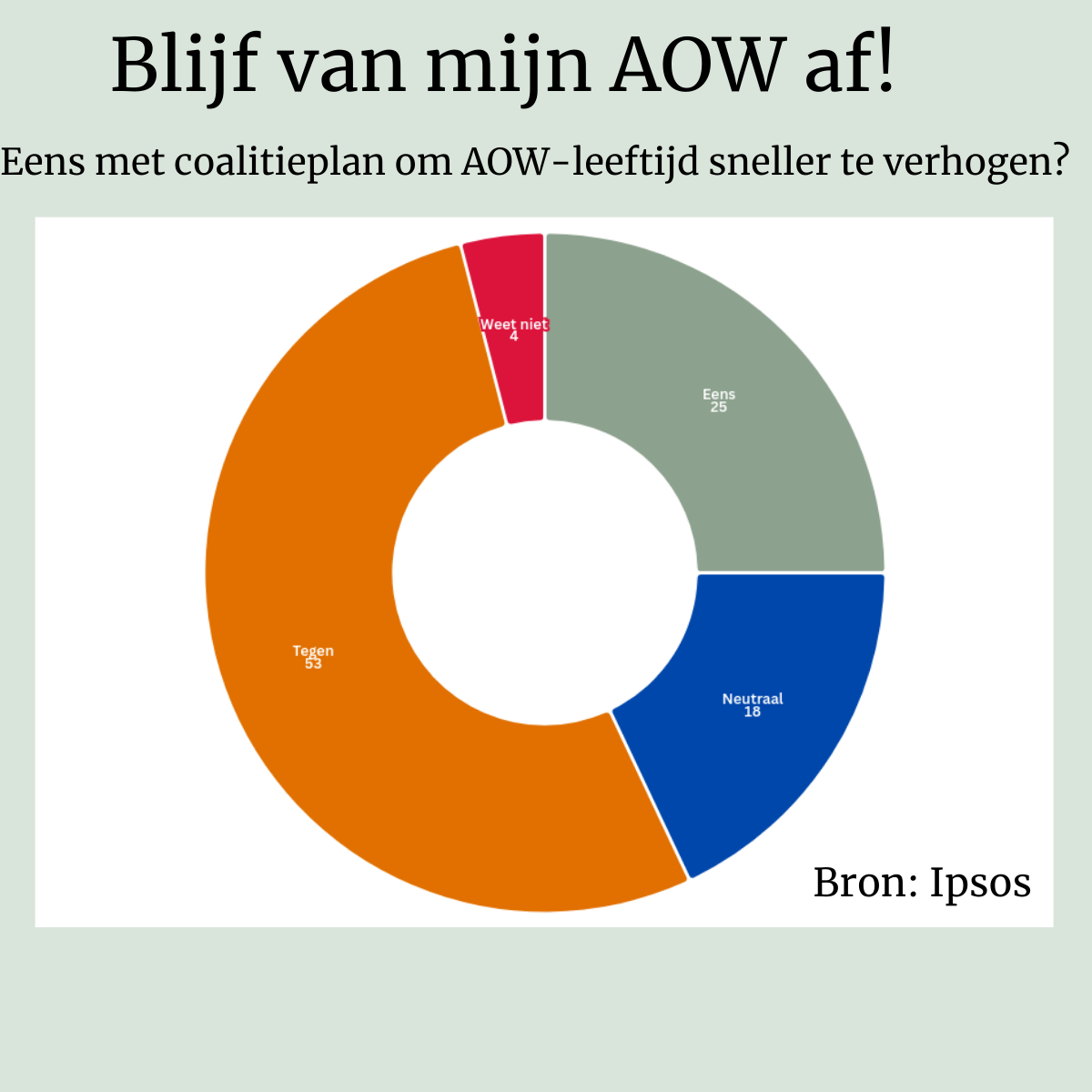

It resonates with broader sentiment in society. A majority of voters (53%) oppose the coalition's plan to link the state pension (AOW) 1-to-1 to higher life expectancy by 2033. 25% agree with it, according to an Ipsos poll.

The faster increase in the state pension age would be antisocial for people with demanding jobs or poor health. It would mean they would have to work even longer, while the finish line is already so far away for them.

Is that correct?

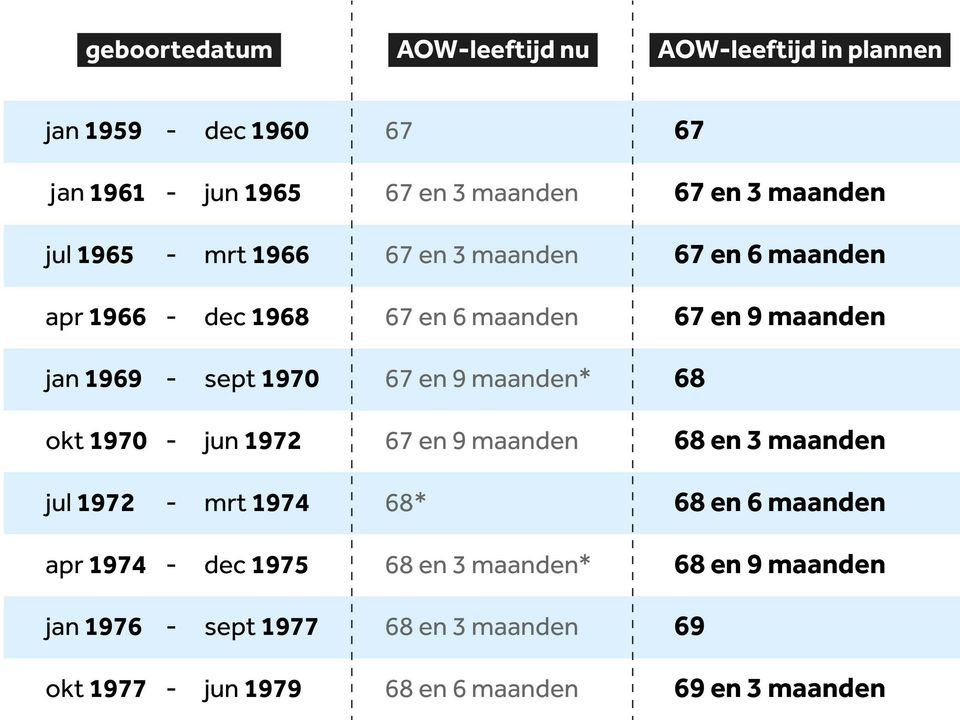

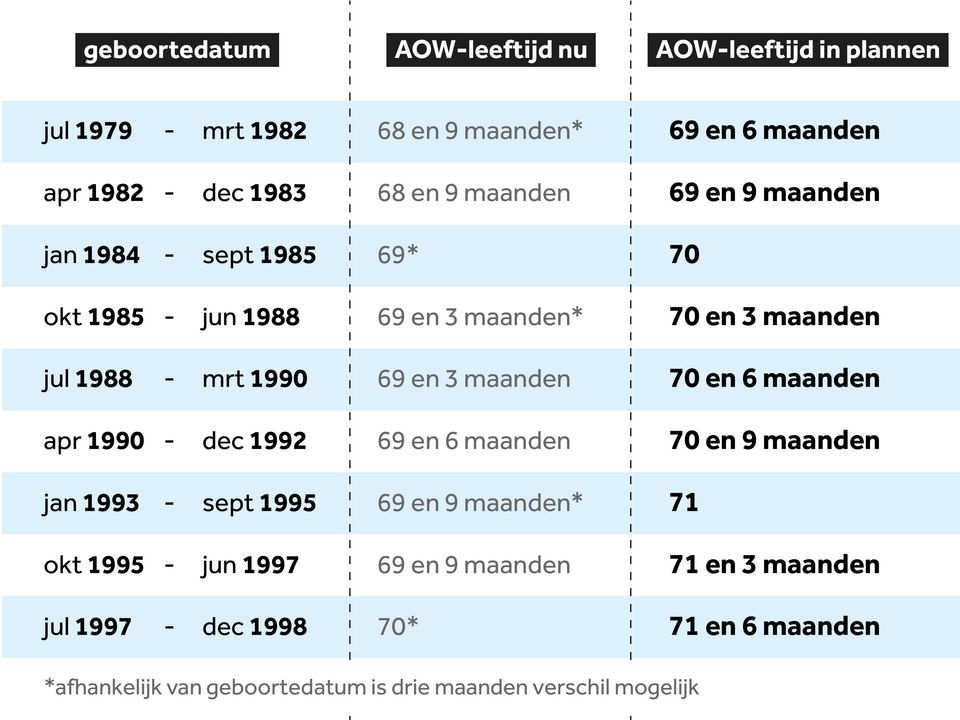

To answer this question, it is important to first examine the details of the coalition plan. The NOS calculated what the plan of the incoming cabinet means for people of different ages. The younger you are, the greater the impact. People in their sixties will notice (virtually) no difference, while those in their forties are expected to have to wait one year longer to receive their state pension, on their 70th birthday. For people in their thirties, the finish line will be pushed back by 1.5 years, to 71.5 years of age.

Calculation & source: NOS

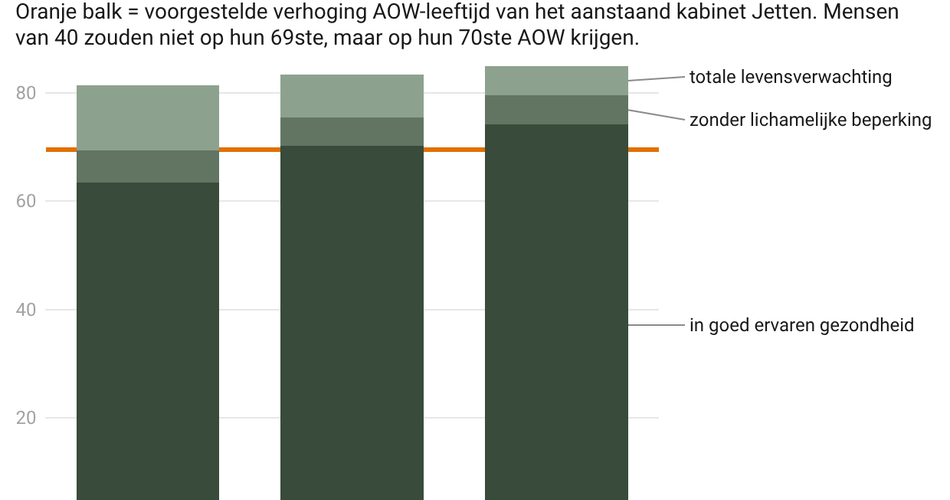

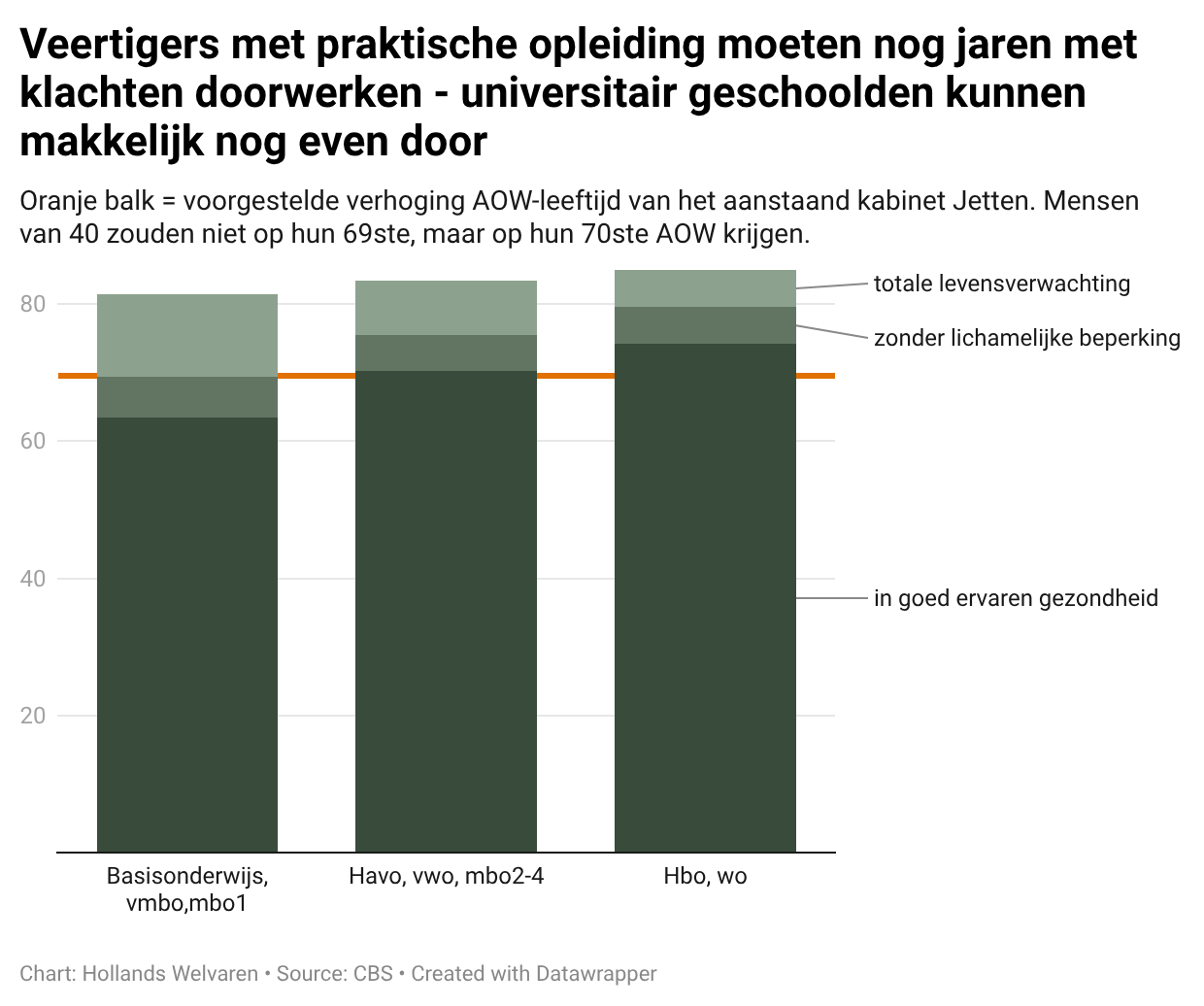

How bad is that for people in their forties? That depends quite a bit on your education. Someone who has studied at university can expect to live to the age of 74 in good health, according to estimates by Statistics Netherlands (CBS). Receiving your old age pension at 69 or 70 doesn't make much difference. But those who have completed practical training are already working in poor health for five years. Working an extra year is asking too much of people.

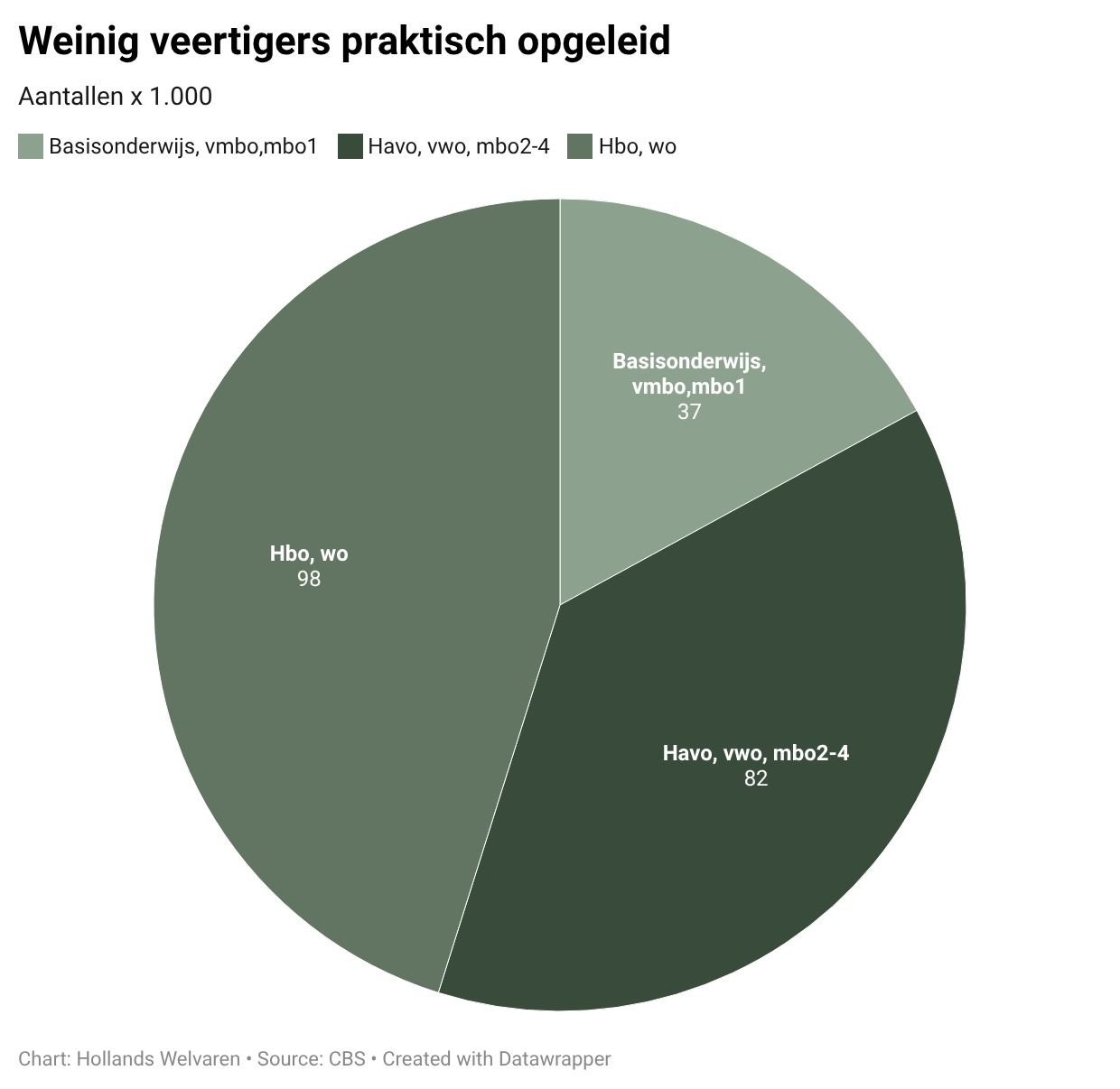

However, the three groups above are not equally sized. More and more people are completing higher professional education or university degrees. Nearly half of people aged 40 have completed such an education. Less than 20% have primary education, preparatory secondary vocational education, or senior secondary vocational education as their highest qualification.

If the retirement age is not raised, those with theoretical training will benefit most, while the situation for many with practical training will remain difficult.

Should the state pension age be raised?

Of course, we could all say: leaving the state pension untouched is a gift we are giving ourselves. It may not be necessary for the largest group, but we are doing it anyway because we can afford to.

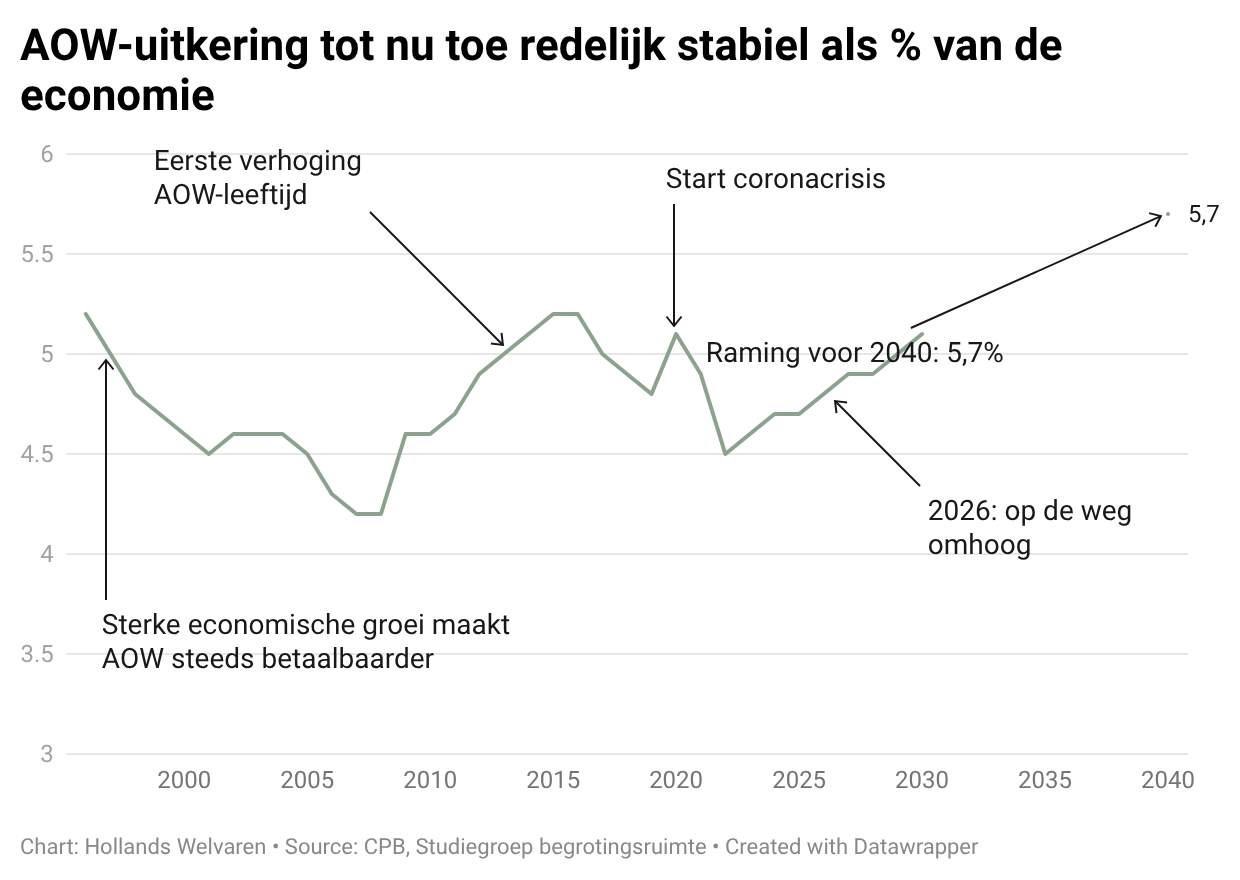

We were indeed able to do that for a long time, but that is no longer possible. Over the past thirty years, AOW expenditure as a percentage of our total economy remained fairly stable at around 5%. This was due to a combination of high economic growth, previous increases in the AOW retirement age, and the high number of deaths during the coronavirus crisis.

However, according to estimates by the Netherlands Bureau for Economic Policy Analysis, AOW expenditure has been rising steadily for several years now, from 4.5% of our economy in 2022 to 4.8% today and 5.1% at the end of this decade.

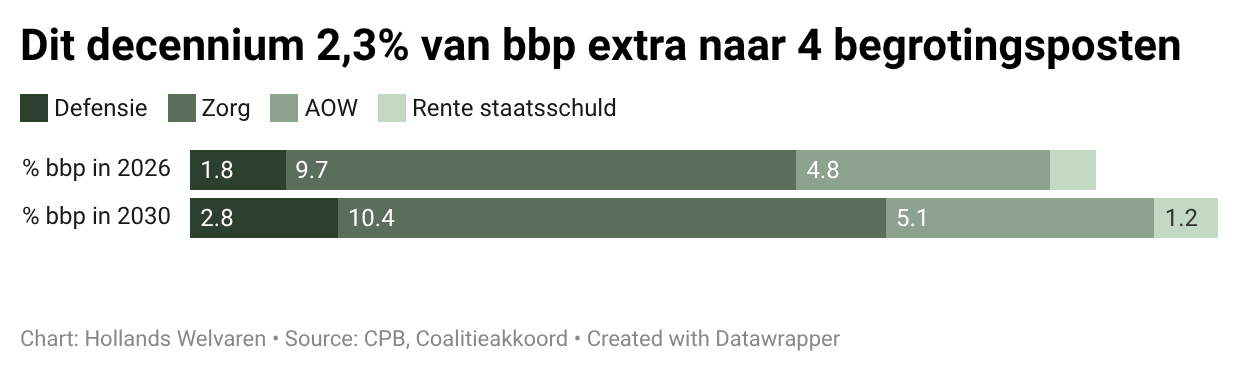

In addition, defense spending will also increase in the coming years (a political choice), and there are structural trends that will cost the treasury money. These include rising healthcare costs and the end of the era of low interest rates, which means we will have to pay more interest on our national debt. All in all, these costs for state pensions, healthcare, defense, and interest will be around €30 billion higher in 2030 than they are now. That is money that will have to be found somewhere.

That is a huge amount. To put it into perspective: if you wanted to achieve that amount through austerity measures alone, you would have to make cuts equivalent to those made by the Rutte I (with PVV support) and Rutte II (with PvdA) cabinets combined. If you wanted to achieve it through additional tax revenue, VAT rates would have to be increased by 6 percentage points.

Socialism for the rich

This article is for paid members only

To continue reading this article, upgrade your account to get full access.

Subscribe NowAlready have an account? Sign In