The new coalition parties are pretending to keep a close eye on the treasury. But they are already increasing spending for their successors by €40 billion, without finding any way to cover it. That and six other notable issues.

Disclaimer: this article was written on the day the coalition agreement was presented. The accompanying financial information was more difficult to understand than in previous formations. As a result, some figures had to be estimated by Hollands Welvaren errors may have crept into the interpretation. Furthermore, some allocations are open to debate: is a higher personal contribution to healthcare a cost-cutting measure or an increase in the burden of costs? If you find any errors, please let us know!

1) Let's start at the beginning: how well does this cabinet fit the treasury?

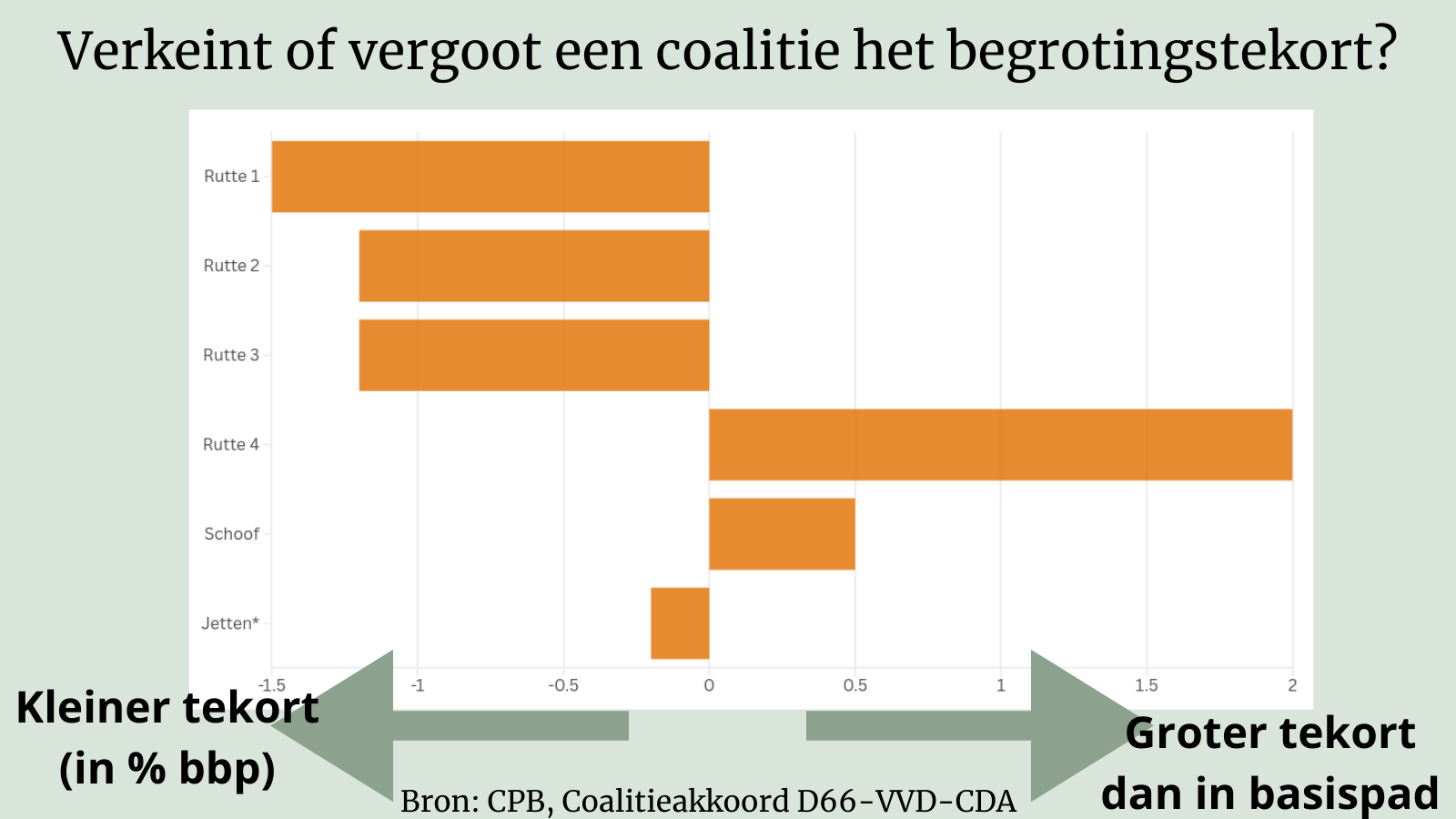

Jetten's incoming cabinet wants to spend a little more one year and a little less the next, without any major fluctuations. Please note: this is in relation to the so-called baseline path, in which government spending is already growing automatically. In 2030, the budget deficit will be reduced by 2.3 billion compared to if Jetten & Co had sat on their hands and done nothing. That is about 0.2% of the total economy (GDP). If you compare that with the previous five cabinets, Jetten is somewhere in the middle. Not as wasteful as Schoof and Rutte in his final years, but also not as decisive as the young Rutte.

2) That's fine, isn't it?

Well, no. In the long term ('structurally'), the government is not making any net savings at all. Last year, an influential group of civil servants said that €7 billion would have to be cut (or taxes increased) in order to cover the costs of an aging population. And that advice from civil servants was already very mild.

Read the previous story here: Where have all the strict accountants gone?

This makes it all the more striking that the parties in the coalition agreement say they want to follow the civil servants' advice. That would mean a budget deficit of no more than 2%, whereas the Netherlands Bureau for Economic Policy Analysis (CPB) assumed a deficit of 2.5% at the end of the coming cabinet term when calculating the election programs. The big question is therefore: will Finance Minister Eelco Heinen be guided by the coalition agreement (2%) or the financial agreements made (2.5%)?

3) Does this also mean that there will be little change in the level of taxation?

The financial appendix to the coalition agreement normally separates spending cuts from investments, and tax increases from tax breaks. This time, that has not been done, which makes comparison difficult. A quick calculation by Hollands Welvaren a net increase of €13.8 billion in government spending over the next four years, particularly on defense (€9 billion). This is the sum of €17.1 billion in increased spending and €3.4 billion in spending cuts.

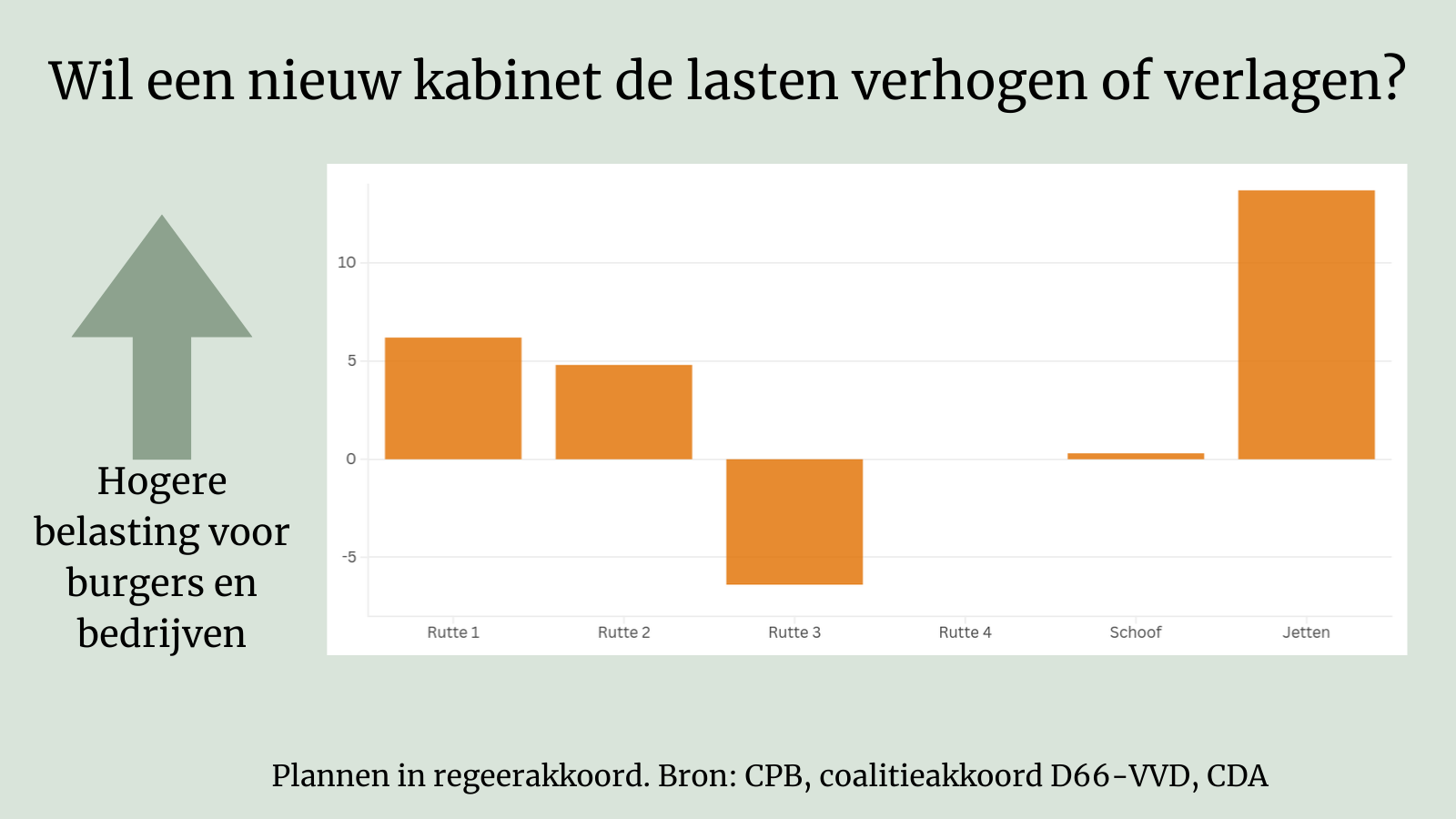

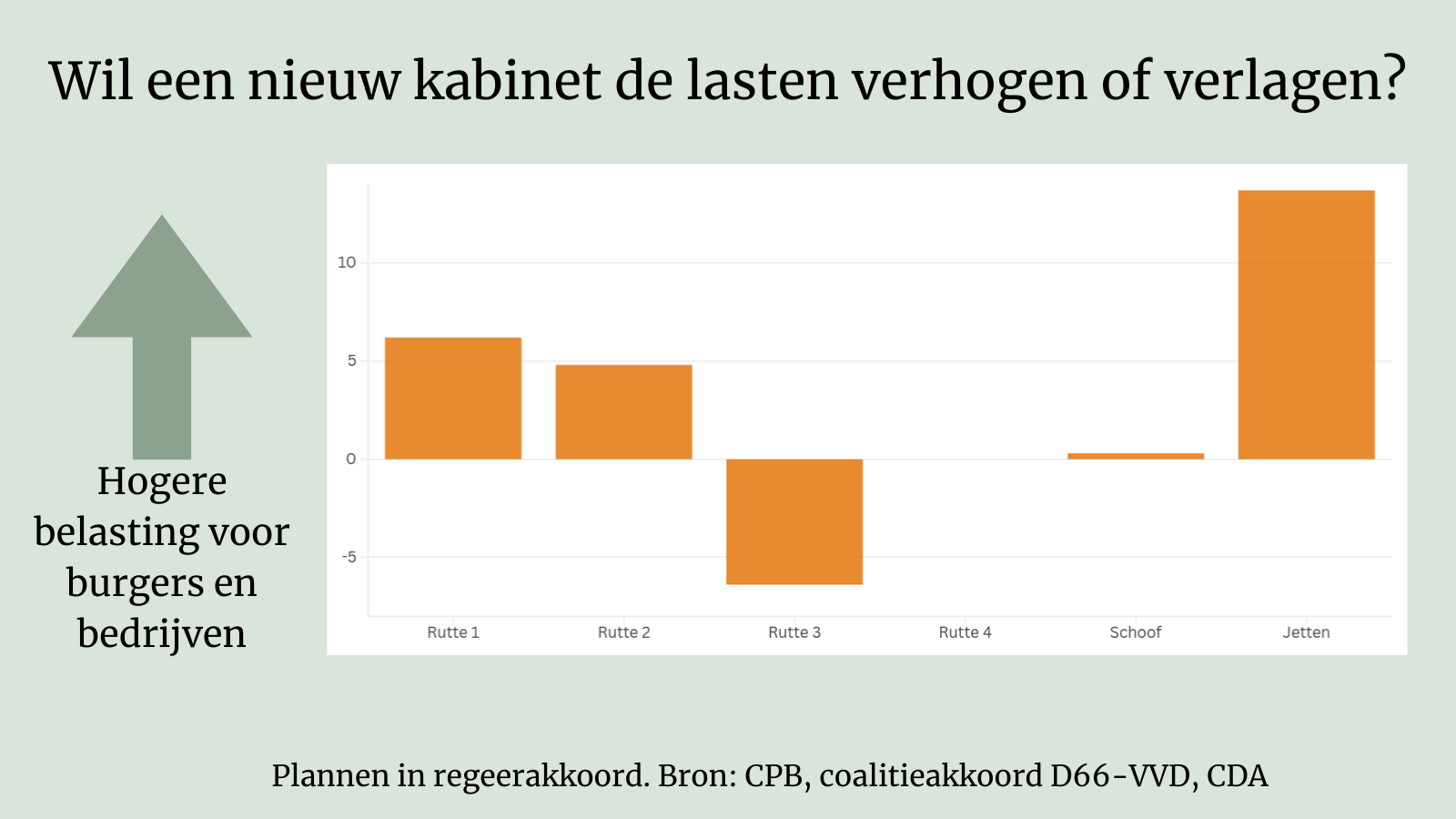

These expenditures are mainly covered by charging citizens and businesses: 13.8 billion. Because the appendix to the coalition agreement is unclear, this is not purely a sum of tax increases, but of all measures that will be borne by citizens. The 'freedom contribution' for Defense is the largest item. But there are also numerous higher personal contributions to healthcare and austerity measures in social security.

In some cases, strictly speaking, these measures will fall under the term 'austerity' rather than 'increased costs', but this calculation makes it clear that the pain will be felt by citizens, not the government. The graph below may therefore differ from the calculation of this agreement that the Netherlands Bureau for Economic Policy Analysis will present shortly.

In this respect, the incoming cabinet is really diverging from its predecessors. They raised taxes much less—for example, by also implementing spending cuts. Rutte 3 was even able to promise substantial tax cuts because the economy was doing very well at the time.

That looks set to be a windfall for the opposition.

4) But don't center-right parties dislike tax increases?

This article is for paid members only

To continue reading this article, upgrade your account to get full access.

Subscribe NowAlready have an account? Sign In